Are you thinking of selling your house? Are you dreading having to deal with strangers walking through the house? Are you concerned about getting the paperwork correct?

Hiring a professional real estate agent can take away most of the challenges of selling. A great agent is always worth more than the commission they charge; just like a great doctor or great accountant.

You want to deal with one of the best agents in your marketplace. To do this, you must be able to distinguish the average agent from the great one.

Here are the top 5 demands to make of your Real Estate Agent when selling your house:

1. Tell the truth about the price

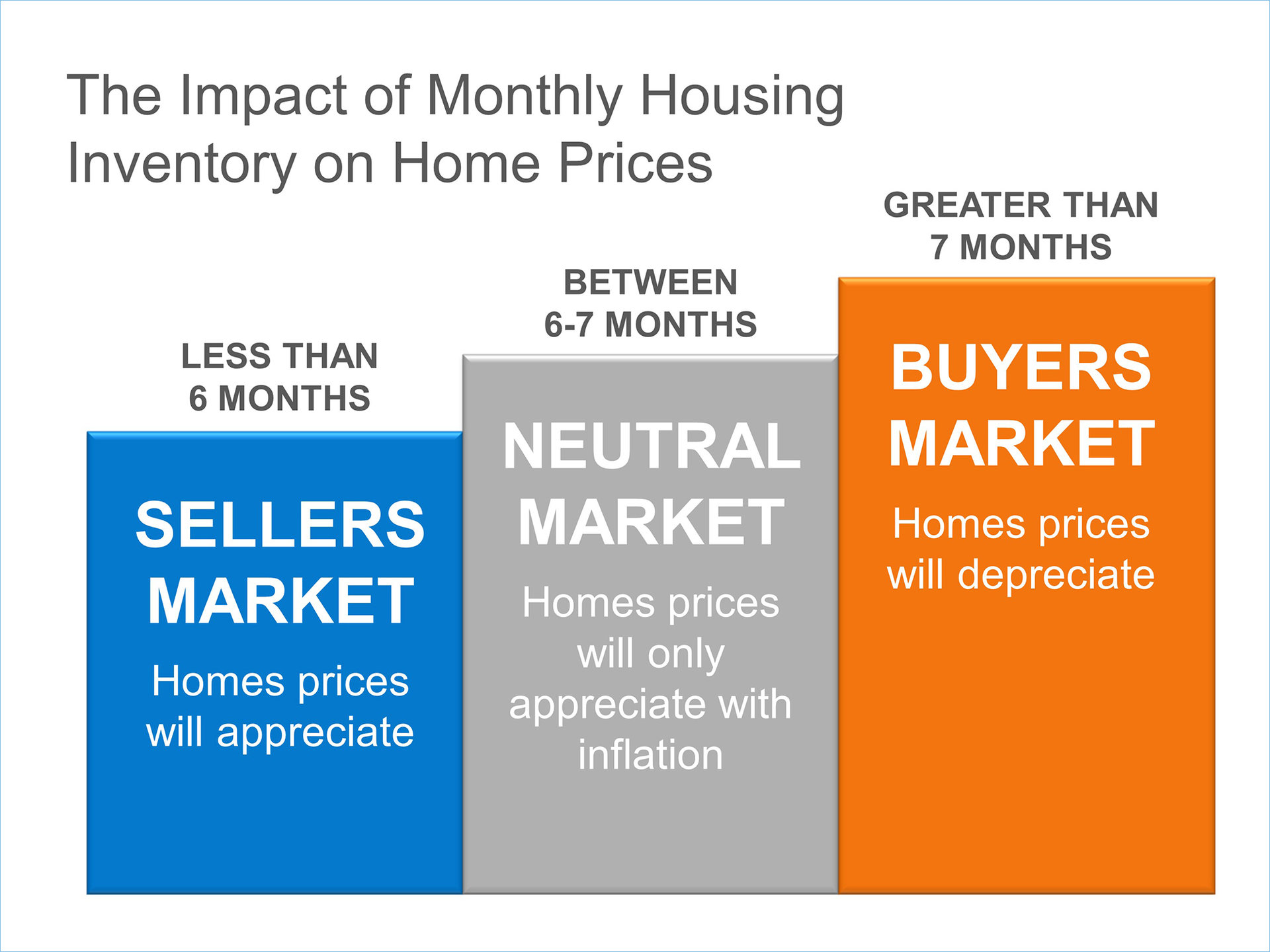

Too many agents just take the listing at any price and then try to the ‘work the seller’ for a price correction later. Demand that the agent prove to you that they have a belief in the price they are suggesting. Make them show you their plan to sell the house at that price – TWICE! Every house in today’s market must be sold two times – first to a buyer and then to the bank.

The second sale may be more difficult than the first. The residential appraisal process has gotten tougher. A survey showed that there was a challenge with the appraisal on 24% of all residential real estate transactions. It has become more difficult to get the banks to agree on the contract price. A red flag should be raised if your agent is not discussing this with you at the time of the listing.

2. Understand the timetable with which your family is dealing

You will be moving your family to a new home. Whether the move revolves around the start of a new school year or the start of a new job, you will be trying to put the move to a plan.

This can be very emotionally draining. Demand from your agent an appreciation for the timetables you are setting. Your agent cannot pick the exact date of your move, but they should exert any influence they can, to make it work.

3. Remove as many of the challenges as possible

It is imperative that your agent knows how to handle the challenges that will arise. An agent’s ability to negotiate is critical in this market.

Remember: If you have an agent who was weak negotiating with you on the parts of the listing contract that were most important to them and their family (commission, length, etc.), don’t expect them to turn into a super hero when they are negotiating for you and your family with the buyer.

4. Help with the relocation

If you haven’t yet picked your new home, make sure the agent is capable and willing to help you. The coordination of the move is crucial. You don’t want to be without a roof over your head the night of the closing. Likewise, you don’t want to end up paying two housing expenses (whether it is rent or mortgage). You should, in most cases, be able to close on your current home and immediately move into your new residence.

5. Get the house SOLD!

There is a reason you are putting yourself and your family through the process of moving.

You are moving on with your life in some way. The reason is important or you wouldn’t be dealing with the headaches and challenges that come along with selling. Do not allow your agent to forget these motivations. Constantly remind them that selling the house is why you hired them. Make sure that they don’t worry about your feelings more than they worry about your family. If they discover something needs to be done to attain your goal (i.e. price correction, repair, removing clutter), insist they have the courage to inform you.

Good agents know how to deliver good news. Great agents know how to deliver tough news. In today’s market, YOU NEED A GREAT AGENT!

Want to see all the homes currently listed for sale? Click here to perform a full home search, or if you're thinking of selling your home, click here for a FREE Home Price Evaluation so you know what buyers will pay for your home in today's market. You can always call us for a FREE home buying or selling consultation at (951) 990-9492 to answer any of your real estate questions.

5/02/2016 08:32:00 AM

5/02/2016 08:32:00 AM

George Lawson

George Lawson